In 2024, the realm of forex trading software continues to evolve, offering traders an array of powerful tools to navigate the dynamic currency markets. Amidst the myriad of options, three platforms stand out as the pinnacle choices for traders seeking efficiency, reliability, and advanced functionalities. These platforms, often regarded as the “pest” in the industry for their widespread adoption and stellar performance, include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Let’s delve into each of these platforms to understand why they are considered the top contenders in the realm of forex trading software.

What is the 3 pest Forex Trading Software?

- MetaTrader 4 (MT4):

- Criteria for selection:

- Popularity and Reputation: MT4 has been the go-to choice for forex traders for many years due to its widespread adoption and positive reputation.

- Features and Tools: MT4 offers a comprehensive range of features including advanced charting tools, multiple timeframes, technical indicators, and support for algorithmic trading.

- User-Friendly Interface: Its intuitive interface makes it accessible to traders of all levels, from beginners to advanced.

- Reliability and Stability: MT4 is known for its stability and reliability, ensuring seamless trading experiences even during high volatility periods.

- Customization Options: Traders can customize MT4 according to their preferences, including creating custom indicators, scripts, and automated trading strategies.

- Criteria for selection:

- MetaTrader 5 (MT5):

- Criteria for selection:

- Advanced Features: MT5 builds upon the success of MT4 with additional features such as more timeframes, additional order types, and an economic calendar.

- Improved Performance: MT5 is optimized for better performance and execution speed, making it suitable for high-frequency trading and handling larger trading volumes.

- Hedging Support: Unlike MT4, MT5 offers hedging capabilities, allowing traders to hold multiple positions in the same instrument simultaneously, providing more flexibility in trading strategies.

- Backtesting and Optimization: MT5 provides enhanced backtesting and optimization capabilities, enabling traders to thoroughly test and refine their trading strategies before deploying them in live markets.

- Criteria for selection:

- cTrader:

- Criteria for selection:

- Intuitive Interface: cTrader is known for its modern and intuitive interface, providing a seamless trading experience across desktop, web, and mobile devices.

- Advanced Charting: cTrader offers advanced charting tools with multiple timeframes, technical indicators, and drawing tools, catering to the needs of both novice and experienced traders.

- Direct Market Access (DMA): cTrader provides direct market access to liquidity providers, offering tight spreads and fast execution speeds.

- Transparency: cTrader’s transparent pricing model and depth of market (DOM) feature allow traders to see market depth and make more informed trading decisions.

- Criteria for selection:

These criteria were selected based on the key factors that traders often consider when choosing a forex trading platform, including features, reliability, performance, user-friendliness, and support for various trading strategies.

1. MetaTrader 4 (MT4):

Product Description: MetaTrader 4 (MT4) is a widely-used and highly-regarded trading platform in the forex industry. Developed by MetaQuotes Software Corp., MT4 offers a comprehensive suite of tools and features designed to meet the needs of both novice and experienced traders. With its user-friendly interface, advanced charting capabilities, and support for algorithmic trading, MT4 has become the platform of choice for millions of traders worldwide.

Pros:

- User-Friendly Interface: MT4 features an intuitive interface that makes it easy for traders to navigate and execute trades efficiently.

- Advanced Charting Tools: The platform offers a wide range of technical indicators, chart types, and drawing tools, enabling traders to perform in-depth technical analysis.

- Algorithmic Trading Support: MT4’s Expert Advisors (EAs) functionality allows traders to automate their trading strategies and execute trades automatically based on predefined criteria.

- Customization Options: Traders can customize MT4 to suit their preferences by creating custom indicators, scripts, and templates.

- Reliability and Stability: MT4 is known for its reliability and stability, with minimal downtime and fast execution speeds, even during periods of high market volatility.

- Extensive Broker Support: MT4 is supported by a vast network of brokers, providing traders with access to a wide range of financial instruments and markets.

Cons:

- Limited Compatibility: While MT4 is available on various operating systems, including Windows, macOS, iOS, and Android, it may not be compatible with all devices and configurations.

- No Hedging Support: Unlike its successor, MetaTrader 5 (MT5), MT4 does not support hedging, which may limit trading strategies for some traders.

- Limited Timeframes: MT4 offers a fixed set of timeframes for chart analysis, which may not be sufficient for traders who require more flexibility in their analysis.

Price: MetaTrader 4 is typically offered for free by most forex brokers. However, traders may incur costs associated with trading, such as spreads, commissions, and overnight financing charges.

Experience: Many traders find MT4 to be an indispensable tool for their trading activities. Its user-friendly interface, advanced charting tools, and support for algorithmic trading contribute to a positive trading experience. Additionally, the extensive broker support ensures that traders have access to a wide range of markets and instruments. Overall, MT4’s reliability, stability, and comprehensive features make it a preferred choice for traders of all levels.

2 MetaTrader 5 (MT5)

Product Description: MetaTrader 5 (MT5) is a powerful trading platform developed by MetaQuotes Software Corp., designed to meet the evolving needs of forex traders and other financial market participants. Building upon the success of its predecessor, MetaTrader 4 (MT4), MT5 offers a broader range of features, advanced tools, and enhanced performance to cater to the demands of modern traders.

Pros:

- Advanced Features: MT5 introduces several new features compared to MT4, including more timeframes, additional order types, and an economic calendar, providing traders with greater flexibility and functionality.

- Improved Performance: MT5 is optimized for better performance and faster execution speeds, making it suitable for high-frequency trading and handling larger trading volumes.

- Hedging Support: Unlike MT4, MT5 offers hedging capabilities, allowing traders to hold multiple positions in the same instrument simultaneously. This provides more flexibility in trading strategies and risk management.

- Backtesting and Optimization: MT5 provides enhanced backtesting and optimization capabilities, enabling traders to thoroughly test and refine their trading strategies before deploying them in live markets.

- Market Depth: MT5 offers market depth information, allowing traders to see the order book and liquidity levels, which can aid in making more informed trading decisions.

Cons:

- Learning Curve: While MT5 shares similarities with MT4, there is still a learning curve associated with transitioning to the new platform, particularly for traders who are accustomed to MT4.

- Compatibility Issues: Some custom indicators, scripts, and Expert Advisors (EAs) developed for MT4 may not be compatible with MT5, requiring traders to adapt or rewrite their trading tools.

- Limited Broker Support: Although MT5 has been available for several years, not all forex brokers offer the platform yet, limiting the choice of brokers for traders who prefer MT5.

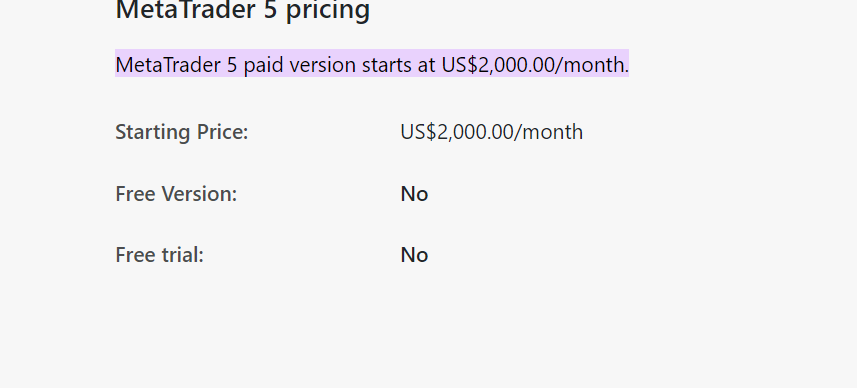

Price: Similar to MetaTrader 4, MetaTrader 5 is typically offered for free by most forex brokers. However, traders may incur costs associated with trading, such as spreads, commissions, and overnight financing charges.

Experience: Traders who make the switch to MetaTrader 5 often appreciate the platform’s advanced features, improved performance, and hedging capabilities. The ability to conduct thorough backtesting and optimization of trading strategies adds value to the trading experience, helping traders make more informed decisions. However, adapting to the new platform and addressing compatibility issues with existing tools may require some adjustment initially. Overall, MetaTrader 5 offers a comprehensive trading experience for traders seeking advanced features and functionality.

3 cTrader

Product Description: cTrader is a sophisticated trading platform developed by Spotware Systems Ltd., offering a modern and intuitive trading experience for forex and CFD traders. Launched in 2010, cTrader has gained popularity for its advanced charting capabilities, transparent pricing model, and direct market access (DMA) to liquidity providers.

Pros:

- Intuitive Interface: cTrader features a sleek and user-friendly interface, providing traders with a seamless trading experience across desktop, web, and mobile devices.

- Advanced Charting: The platform offers advanced charting tools with multiple timeframes, technical indicators, and drawing tools, empowering traders to conduct comprehensive technical analysis.

- Direct Market Access (DMA): cTrader provides direct market access to liquidity providers, offering tight spreads and fast execution speeds with minimal slippage.

- Transparency: cTrader’s transparent pricing model and depth of market (DOM) feature allow traders to see market depth and real-time order book data, enhancing transparency and market visibility.

- Algorithmic Trading Support: cTrader supports algorithmic trading through its cAlgo platform, enabling traders to develop and deploy custom trading robots (cBots) and indicators.

- Customization Options: Traders can customize cTrader with personalized watchlists, chart templates, and layout configurations, tailoring the platform to their trading preferences.

Cons:

- Limited Broker Support: While cTrader is supported by a growing number of forex brokers, it may not be as widely available as other trading platforms such as MetaTrader.

- Learning Curve: New users may experience a learning curve when transitioning to cTrader, particularly if they are accustomed to other trading platforms.

- Availability of Third-Party Tools: Compared to platforms like MetaTrader, cTrader may have fewer third-party indicators, Expert Advisors (EAs), and other trading tools available for use.

Price: cTrader is typically offered for free by forex brokers that support the platform. However, traders may incur costs associated with trading, such as spreads, commissions, and overnight financing charges.

Experience: Traders who use cTrader often appreciate its modern interface, advanced charting capabilities, and transparent pricing model. The platform’s direct market access feature ensures competitive pricing and reliable execution, contributing to a positive trading experience. While there may be a learning curve for new users, the platform’s intuitive design and customization options allow traders to tailor cTrader to their specific trading preferences. Overall, cTrader offers a comprehensive trading solution for traders seeking advanced features and transparency in their trading activities.

Conclusion/Summary

In conclusion, MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader emerge as the top contenders in the landscape of forex trading software in 2024. These platforms are revered for their user-friendly interfaces, advanced charting tools, algorithmic trading capabilities, and reliability. MT4’s longstanding reputation and extensive broker support make it a staple choice for traders, while MT5’s enhanced features and hedging support cater to more sophisticated trading strategies. On the other hand, cTrader’s modern interface, direct market access, and transparency in pricing position it as a formidable competitor in the market. Whether traders prioritize familiarity, advanced functionalities, or transparency, these three platforms offer comprehensive solutions to meet diverse trading needs in the dynamic forex market of 2024.